Demand for Transparency from DeFi Education Fund

Yesterday, we noticed that 500k of the 1m UNI received by the DeFi Education Fund was sold for USDC without explanation.

DeFi Education Fund is dumping 500k $UNI all at once for $10.2M in USDC.

— Chris Blec (@ChrisBlec) July 13, 2021

Why in the hell do they need $10.2M all at once? Why not just sell the UNI as they need it??

It's amazing that UNI governance has absolutely no say in what is happening here. https://t.co/IsU7wCzZcI

Today, I made the following post on Uniswap's governance forum, directed to those who are controlling governance. You can see the original post here. Following is the text of the post.

The DeFi Education Fund committee members, the Uniswap core team and its investors (including a16z) have refused to answer any specific questions posed to them about the fund’s origins, who came up with the idea, how future policy will be derived, and more.

In this letter dated June 24, I asked the proposer some very specific questions about these issues that were willfully ignored (and, in fact, ridiculed by inside parties):

LETTER 1: https://drive.google.com/file/d/1owPENFK18Q2kGqDPs17nrAl-p1bKMnaJ/view

After the vote finished and the Fund was created, I sent a new set of questions on June 29 to a16z, as it appeared that the vote only won due to governance delegates using voting power given to them by a16z. These questions were also willfully ignored:

LETTER 2: https://drive.google.com/file/d/12JZESGPKhRPyxhGKAqv4wJBMg4dlgJUs/view

The Fund was subsequently created and 1m were sent to the Fund’s multisig.

Yesterday, without any explanation as to “why”, and with no real notice to the UNI governance community (aside from this tweet a few minutes before the sale), 50% of the UNI sent to the Fund were sold to Genesis Trading.

With the help of @GenesisTrading, we sold 500k UNI for ~$10.2M USDC in order to fund the efforts of the Defi Education Fund.

— Defi Education Fund (@fund_defi) July 12, 2021

In the next 24 hours, we will be sending 500k UNI to Genesis and receiving ~$10.2M USDC in return.

It’s time for us to stop “requesting” and time to start “demanding”. This has been promoted as a decentralized governance community, however over the past 6 weeks it has not behaved as such. We (concerned members of the UNI governance community) deserve answers and now we are demanding them.

We demand answers to this abbreviated list of questions by the Fund committee members, the proposer (Harvard Law BFI), the Uniswap team and/or its investors including a16z. Whoever has the answers should provide the answers today.

- Who did Harvard Law BFI discuss this proposal with before bringing it to the public? Were there discussions with or encouragement from past or current Uniswap core team members, investors, proposed committee members, or other influential backers such as Consensys? If there were internal conversations, why were they not made public prior to a firm, unchangeable proposal being made?

- Who contacted each proposed committee member to tell them about the Fund and to ask them to be on the Committee? (This is assuming that the proposal was not the committee members’ own idea.)

- Was this proposal drafted in response to any ongoing, suggested or expected government investigation of the Uniswap corporate entity (Universal Navigation, Inc.) or any of its employees or investors that inside parties were made aware of? If yes, why was this information not made public to add context to the proposal?

- What conversations led to a member of the World Economic Forum being on the committee alongside known DeFi attorneys?

- How can UNI tokenholders be assured that the committee will not use its free

reign to start new spin-off organizations that are no longer beholden to UNI interests? - What assurances do UNI tokenholders have that members of the proposed committee will not pay funds to themselves or to other organizations that they have a vested interest in?

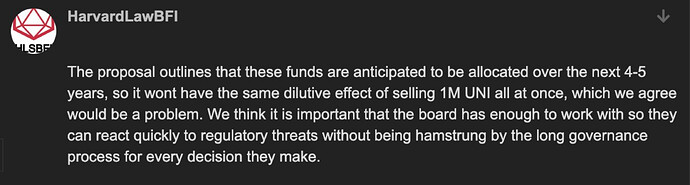

- Harvard Law BFI, the proposer, clearly intended for the UNI to be sold over a 4-5 year period. Why was 50% of the UNI sold, all at once, for USDC on July 12, 2021? Why was the UNI not sold via Uniswap over a longer period of time (i.e. a Uniswap v3 LP position with a tight upper range)?

8. Why did a Fund committee member sell 2,612 UNI just a few hours ahead of the 500k UNI sale mentioned in #7? Does the Fund, core team or investors consider it acceptable for committee members to trade UNI with inside information about massive sales like this?

1/3

— Igor Igamberdiev (@FrankResearcher) July 13, 2021

Looks like Larry Sukernik, one of the multi signers behind the $20M DeFi education fund, dumped UNI five hours before the $10M OTC sale. pic.twitter.com/JWlxZC2L4Q

You need to engage in open dialogue immediately. This decentralized community does have power that extends beyond simple voting rights. Please think twice before testing that power any further.